LCCA vs LCA

Life Cycle Cost Assessment (LCCA) has a lot of overlap and can be confused with Life Cycle Assessment (LCA) due to the similar acronym. LCA focuses on the environmental impact (energy, extraction, operation, etc) of the architectural system or product.

Introduction

Life Cycle Cost Assessment (LCCA or LCC) calculates the total economic impact of a product, building, or building component throughout its entire life cycle or period of time (typically in years). It’s essentially a method of evaluating the total cost of something over a period of time, including its initial cost, operations, maintenance, replacement, disposal, and taxes/financing.

- Example: Comparing the cost of buying, operating, and then replacing an object after X amount of years vs paying for a higher quality, more expensive object and replacing it Y number of years.

Study Period: The period of time for the LCC

- Duration of the study period varies with needs of the client and the anticipated usefulness of an item.

- Common to account for inflation and adjust for future time or past when considering the study period.

Sunk Costs: Costs and expenses that have been incurred prior to baseline date and cannot be recovered.

- These are ignored during the LCC. For example, having to spend more money to expedite the shipping in order to receive the product by X date for opening. This is a sunk cost.

Matrix Costing: Decisions that allow a more efficient building skin may cost more, but can reduce other components of the building. This style or method of economic analysis is called matrix costing.

Usefulness

Using an LCCA allows two or more alternatives to be evaluated and their total costs to be compared. This is especially true for energy considerations where one system may cost more upfront, but will perform better and ultimately will save money in the long run.

Components of an LCCA

Here are the standard components to an LCCA — essentially what values or factors to consider. Note that some LCCA may disclude some of these while others may add more factors.

- Initial Cost

Initial cost of an item, including installing the system/item into the building. A more expensive item may be easier to install, or have a longer lifespan and easier maintenance leading to a long term benefit.

- Operational Cost

Cost of operating through electricity, water, or other utilities. Designing a more expensive and better performing facade, may allow the mechanical system to be downsized and save money over long term operations and initial cost. Consider not just the operation cost of the item, but how it affects other systems as well.

- Maintenance

Costs of the item over the study period including any maintenance or repair costs.

- Replacement

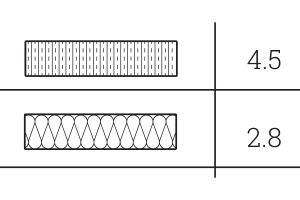

Expected replacement costs during the study period. Some products have lifespans regardless of what type you purchase, for example light bulbs.

- Finance

Any financing costs associated with the purchase of the object or assembly.

- Taxes

If any for the initial costs and operating costs occur taxes.

- Residual Value

Remaining value of the element at the end of the study period based on resale value, salvage value, value in place, or scrap value. Any residual value is calculated into the present value, then discounted from the total to establish an overall final life-cycle cost.

Leave a Reply

You must be logged in to post a comment.